Introduction:

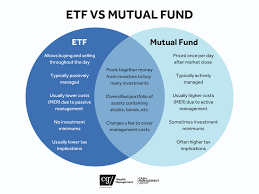

ETFs and mutual funds both offer diversified investment opportunities, but they’re not the same. Here’s how to choose between them based on cost, flexibility, and strategy.

Subheadings:

- Trading Structure

• ETFs trade intra-day like stocks

• Mutual funds trade once daily at NAV - Expense Ratios & Fees

• ETFs often have lower expense ratios

• Mutual funds may carry sales loads & 12b‑1 fees - Tax Efficiency

• ETFs use “in-kind” creations to reduce capital gains

• Mutual fund redemptions can trigger taxable events - Minimum Investment

• ETFs: 1 share plus brokerage fees

• Mutual Funds: $500–$3,000 minimum - Automatic Investment Options

• ETFs require manual setup

• Mutual funds offer auto-invest and dividend reinvestment plans

Conclusion & CTA:

Choose ETFs if you value low fees, tax efficiency, and intra-day trading. Opt for mutual funds if you prefer automatic investing or payroll deductions. Want modeled portfolio examples? Download our ETF vs. Mutual Fund comparison guide.